Tax Technology Consulting & beyond

Vertex - Avalara - Wolters Kluwer - Thomson Reuters

Implementations - Upgrades - Migrations - Integrations - Support

Expertise

Versatility

Value

Reliability

Vertex Q Series and Vertex L Series

upgrades to Vertex O Series and Cloud

Complete cost-effective tax technology implementations, upgrades and support

Seamlessly integrate Vertex O Series or Vertex Cloud tax engines with your existing ERPs or billing systems. KMMH connectors support legacy application and do not require host system upgrades or platform migrations.

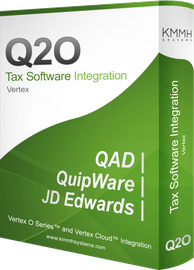

KMMH Q2O upgrade and integration connector is for users moving to O Series or Vertex Cloud from host systems currently integrated with Vertex Q Series, such as JDE, QAD, QuipWare or custom solutions.

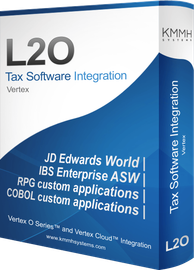

KMMH L2O upgrade and integration connector is for users migrating to O Series or Vertex Cloud from RPG-based systems running on IBM iSeries servers, such as JDE World or custom billing programs currently integrated with Vertex L Series.

Implementations and Upgrades

Sales Tax - Use Tax - VAT - Lease - Telecommunications - Payroll

Vertex Software Upgrades

Lift & Shift upgrade service provides a non-invasive replacement of an existing Vertex Q-Series or Vertex L-Series tax automation software with Vertex O-Series or Vertex Cloud tax engine in many different environments, including SAP, JDE, JDE World, QAD, legacy, home-grown and others. For upgrade projects where the existing integration does not work with the new tax engine, KMMH can supplement or replace the existing integration as needed.

Tax Technology Implementations

KMMH Systems, LLC provides custom end-to-end tax automation technology implementations for corporations ranging in size and industry. Our deliverables include compliance process review, business, and technical requirements review, project management, solution design and development, taxability setup, solution testing, user training, go-live support, tax/ERP system reconciliation, off-hours support, data intelligence, and transformation. Outline of our end-to-end

Implementation service.

Upgrade Connectors and

Custom Integrations

In-house design and development by subject matter experts who understand tax.

Robust cost-saving solutions enable companies to implement advanced tax engines independently of ERP upgrades.

Team KMMH

Unique tax automation and tax software experience

Understanding of tax compliance, technical requirements, and implementation challenges

Bruno worked as an employee of Vertex, Inc. for ten years and Sabrix, Inc. (now part of Thomson Reuters, Inc.) for three years. In 2007, Bruno formed Bruno Solutions, LLC, and provided tax automation services to over 50 companies, ranging from multinationals to startups. Bruno created numerous advanced tax automation connectors, including Vertex's Translink integration for SAP. He led development teams developing and maintaining software interfaces. Bruno designs and implements tax solutions for clients with tax calculation automation, reporting, and compliance needs across the globe.

John worked for Vertex for 25 years as a product strategy leader and enterprise software architect. He led multiple tax calculation and compliance product teams, including sales tax, telecommunications tax, and VAT. Furthermore, John served as the Technical Director of the Vertex Innovation Labs. John brings extensive experience in ERP tax automation, Cloud Architecture, Agile methodologies, Business Process Modeling and Management, Content Management systems, and Blockchain. John works with clients desiring cutting-edge technologies and opportunities in tax automation and beyond. John co-authored "Somewhere on the Spectrum...: Once Upon a Business".

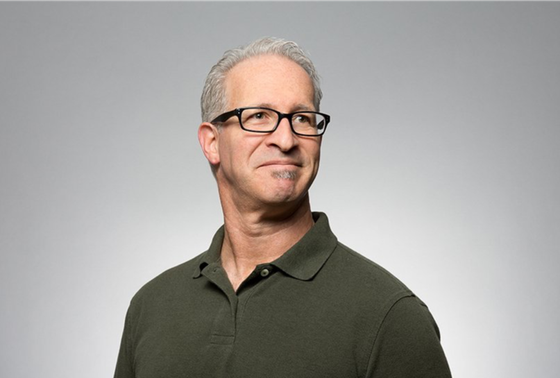

Richard was employed by Vertex, initially as a customer support specialist, followed by a software engineer position . His last two years at Vertex were with Vertex Consulting. In 2005 Richard launched a Vertex implementation partner company, MK Strategies. In 2021, Richard joined forces with other former Vertex software engineers and founded KMMH Systems, LLC. Richard earned his Master’s degree at George Washington University. In his free time, Richard is likely airborne, volunteering with Civil Air Patrol.

Don’t take our word for it

"The solutions, customer service, and value provided have allowed us to extend the life of one of our main ERP applications resulting in a lower total cost of ownership in our overall IT budget. They are quick, smart, and responsive to every challenge we have given them."

Eric Dumas, Exela Technologies

How Can We Help You?

Please get in touch with us if you are looking for people who can see the big picture and are passionate about solving technical challenges, whether those challenges lie in tax automation or not. We're happy to discuss your situation with you. Even if it's not something we can help you with, we probably know someone who can.

Send Us a Message

Your message has been sent. Thank you.

About Us

KMMH Systems provides exceptional implementation and consulting services in tax automation and beyond.

Contact Us

888-888-8291

richard@kmmhsystems.com

7901 4th St N STE 300

St. Petersburg, FL 33702